Auto Insurance in and around San Bernardino

Auto owners of San Bernardino, State Farm has you covered

Let's hit the road, wisely

Would you like to create a personalized auto quote?

- San Bernardino

- Highland

- Redlands

- Riverside

- Grand Terrace

- Rialto

- Colton

- Loma Linda

- Yucaipa

- Calimesa

- Fontana

- Rancho Cucamonga

- Ontario

- Corona

- Victorville

- Moreno Valley

- Murrieta

- Hesperia

- Upland

- Claremont

- Eastvale

- Norco

- Alta Loma

- Montclair

You've Got A Busy Schedule. Let Us Help!

State Farm isn't afraid of the unexpected, and with our fantastic insurance, you don't have to be either. With a number of options for coverage and savings, you can be sure to choose a policy that fits your unique needs.

Auto owners of San Bernardino, State Farm has you covered

Let's hit the road, wisely

Agent Melissa Milender, At Your Service

State Farm's wonderful options for auto coverage include, but are not limited to, emergency road service coverage, collision coverage and liability coverage. Additionally, you may also qualify for our outstanding savings options, like a newer vehicle safety features discount, the Good Driver Discount, Drive Safe & Save™, and more! Your State Farm agent Melissa Milender can help you sort through what options are right for you.

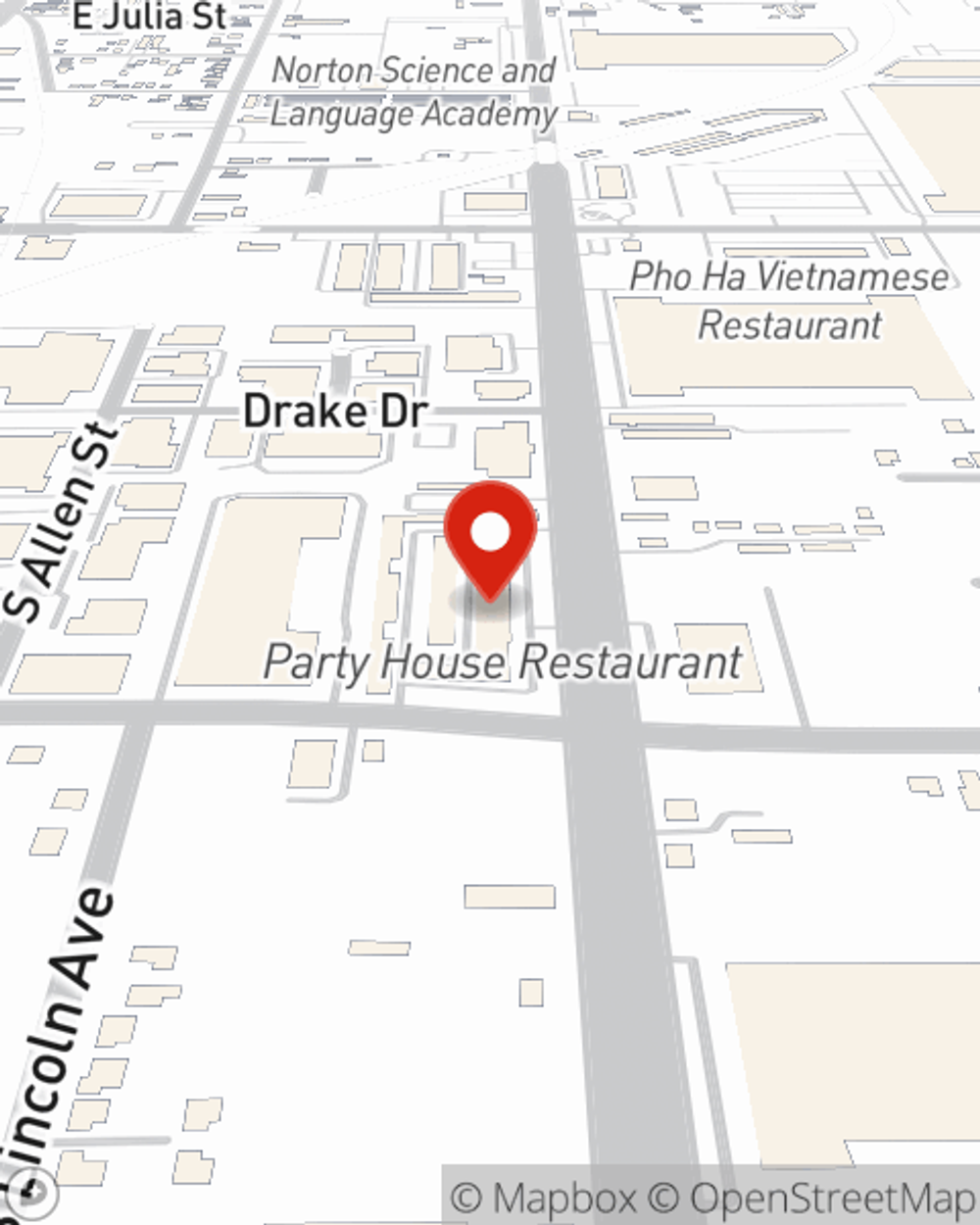

Call or email agent Melissa Milender's office to learn the advantages of State Farm's auto insurance.

Have More Questions About Auto Insurance?

Call Melissa at (909) 522-3300 or visit our FAQ page.

Simple Insights®

Rideshare accident: What should drivers do after an accident

Rideshare accident: What should drivers do after an accident

Crashed while driving for Uber/Lyft? Learn tips on how to handle the rideshare claim process, what info you need & which coverage applies based on your app status.

Protecting your car: Do I need collision insurance?

Protecting your car: Do I need collision insurance?

Learn what collision coverage is, what it helps pay for after a car crash, how deductibles work and if you need this coverage.

Melissa Milender

State Farm® Insurance AgentSimple Insights®

Rideshare accident: What should drivers do after an accident

Rideshare accident: What should drivers do after an accident

Crashed while driving for Uber/Lyft? Learn tips on how to handle the rideshare claim process, what info you need & which coverage applies based on your app status.

Protecting your car: Do I need collision insurance?

Protecting your car: Do I need collision insurance?

Learn what collision coverage is, what it helps pay for after a car crash, how deductibles work and if you need this coverage.